Model Portfolios

NDR offers turnkey solutions based on our objective, data-driven approach.

Model portfolios include global tactical asset allocation, equity and fixed income sector rotation, and thematic and factor-based stock strategies.

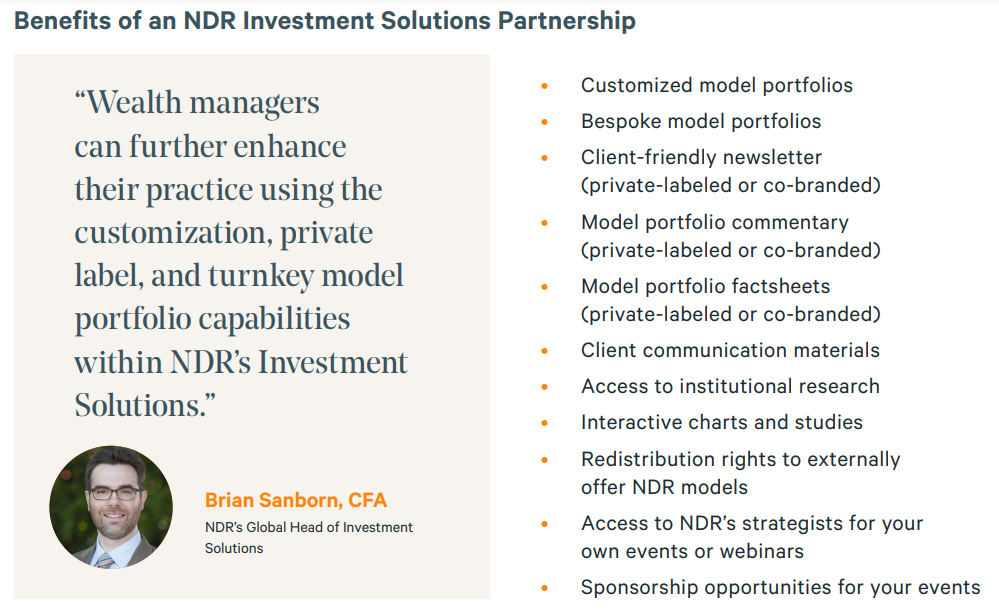

An Investment Solutions Partnership can help with tactical allocation and scaling your practice. Additional benefits include co-branded or private-labeled materials and access to strategists for speaking engagements. Please view our capabilities brochure to see how NDR can help you apply the signals.

Sign up for NDR's complimentary (subject to NDR's Terms of Service) Wealth offering, which contains regular updates on NDR's model portfolios, as well as monthly market + macro insights, weekly summary bullets, educational charts, and basic screening tools.

Investment Solutions

Elana/NDR Dynamic Strategy

Invests in 13 different assets including U.S. equities, global equities, fixed income, and cash. NDR's dynamic automated investment strategy changes asset class shares based on a set of objective indicators that capture financial market trends in an attempt to minimize the effects of downturns in critical market times. The diversified portfolio consists of highly liquid exchange traded funds (ETFs) with US stocks and bonds, developed markets , and emerging markets. Bulgarian investors have economical access to ETFs from the United States, which are available to non-professional investors in Europe.

-

How to access

- Fund: BG9000017210 (exits ndr.com)

NDR Active Allocation - Kathrein Strategy

The NDR Active Allocation - Kathrein fund is a dynamically managed balanced fund-of-fund using exchange traded funds (ETFs) for the various asset classes of stocks, bonds, and money markets. The individual asset classes can be over or underweighted based on quantitative models depending on the current market situation independent of the benchmark. The investment decisions may use the research and the capital market forecasts of Ned Davis Research (NDR).

-

How to access Fund

NDR Dynamic Asset Allocation Strategy

Invests in 13 different assets including U.S. equities, global equities, fixed income, and cash. This model utilizes a turnover-reducing algorithm to keep trading cost down and rebalances monthly, providing a tactical asset allocation overlay to the ETF investable asset classes.

How to access

-

- Factsheet

- Latest Commentary

- Morningstar Separate Account Database ID: F000011WP0

-

SMA

- Amplify (exits ndr.com)

- FinaMaze (exits ndr.com)

- GeoWealth (exits ndr.com)

- SmartLeaf (exits ndr.com)

Direct Indexing

- C8 Technologies (exits ndr.com)

NDR Fixed Income Allocation Strategy

Merges macroeconomic and technical indicators in a weight-of-the-evidence approach to allocate across nine fixed income sectors including duration, quality, and geographies.

-

How to access

- Factsheet

- Latest Commentary

- Morningstar Separate Account Database ID: F000015FU7

-

SMA

Direct Indexing

- C8 Technologies (exits ndr.com)

NDR Global Allocation Strategy

A disciplined tactical asset allocation strategy that objectively combines indicators to invest in promising opportunities across asset classes and regions.

-

How to access

-

SMA

- GeoWealth (exits ndr.com)

Direct Indexing

- C8 Technologies (exits ndr.com)

NDR International Equity Allocation Strategy

A disciplined, tactical allocation strategy that objectively combines indicators to invest in promising opportunities across non-U.S. equities.

-

How to access

-

SMA

NDR Sector Allocation Strategy

Combines trend, behavioral, fundamental, and macroeconomic indicators in a weight-of-the-evidence approach to assign tactical asset weights vs. a cap-weighted benchmark of eleven sectors within the U.S. large-cap space.

-

How to access

- Factsheet

- Latest Commentary

- Morningstar Separate Account Database ID: F000015FU8

-

SMA

Direct Indexing

- C8 Technologies (exits ndr.com)

VanEck Vectors Long/Flat Trend Strategy

VanEck Vectors Long/Flat Trend ETF (LFEQ®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Ned Davis Research CMG US Large Cap Long/Flat Index (NDRCMGLF). The NDRCMGLF Index follows a proprietary model that determines when, and by how much, it allocates to U.S. equities and/or U.S. Treasury bills to seek to help avoid losses in declining markets or capitalize from rising markets. The model produces daily trade signals to determine the Index's equity allocation percentage (100%, 50%, or 0%).

-

How to access

- NDRCMGLF Rule Book

- NDRCMGLF Index Readings (exits ndr.com)

- ETF: LFEQ (exits ndr.com)